Give

Ways to Give

Contributions may be mailed to:

Second Presbyterian Church

600 Pleasant Valley Dr.

Little Rock, Arkansas 72227

Online

Your generosity is a meaningful expression of your faith in God and your commitment to Christ’s work in the world.

Online Giving Options

Annual Budget

The annual operating budget of Second Presbyterian Church enables congregation members to support our ministries of worship and music, Christian nurture and education, pastoral care and fellowship, compassion and justice. Support of the annual operating budget is the primary way these ministries are funded.

Make An Offering

Estimate of Giving 2025

Click the link below to fill our your Estimate of Giving for 2025. This form is confidential and goes directly to Aileen Moore, Church Business Administrator.

Estimate of Giving 2025

Memorial Gifts

Memorial gifts may be made in any amount to memorialize a deceased loved one or to honor a birth, anniversary, or other special person or event in your life. Church staff will send a memorial letter to whomever you designate, informing them of your gift.

Memorial Gifts

Planned Giving

Planned Giving is a gift, usually through an estate, to support the ministries of our church.

Birthday Fund

During your birthday month, celebrate your birthday by giving a dollar for each year of your life to our Church’s endowment fund. Whether you are 1 or 101 years of age, this gift gives back for all the blessings in your years. Our endowment fund provides financial support for all of our Church’s missions and ministries.

Birthday Fund Form

Presbyterian Women

We are grateful for the fellowship, service and study of women at Second Presbyterian Church. Presbyterian Women supports a number of mission and outreach endeavors. To support our PW ministries or purchase a study guide, click on the button to make a pledge or order the study book. For information, contact Emily Hall, Moderator. It is out hope that you can join us.

Presbyterian Women Pledge/Study Books

Presbyterian Women Birthday Fund

The Steve and Missie Hancock Scholarship Fund

Our church has established a scholarship fund in honor of Steve and Missie and in support of Steve’s passion for excellent pastoral leadership. Scholarships will be awarded to Second Presbyterian seminary students to lower financial barriers to being effective pastors. Your gifts toward the fund will be invested through our endowment fund, so that the earnings will continue to support the formation of pastoral leaders for years to come.

Steve and Missie Handcock Scholarship Fund

Planned Giving

Dear Members and Friends,

In one of the most beautiful and compelling passages of scripture we are called to a special and joyful purpose. “Hear, O Israel: the Lord is our God, the Lord alone. You shall love the Lord with all your heart, and with all your soul, and with all your might.” (Deut 6:4-5) Jesus adds that we should love our neighbor as ourselves.

Read More

Just after these words, Deuteronomy reminds us of a truth we already know—that we live in cities that we did not build; that we drink water from wells that we did not dig; that we eat from vineyards that we did not tend. (Deut 6:10-11)

Additional Options for Giving

Popular Options

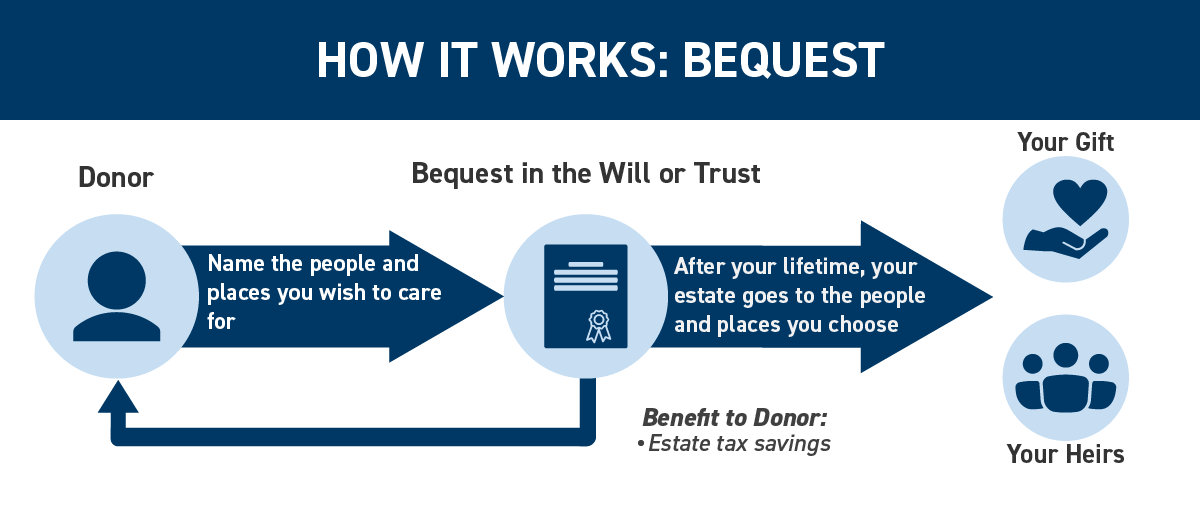

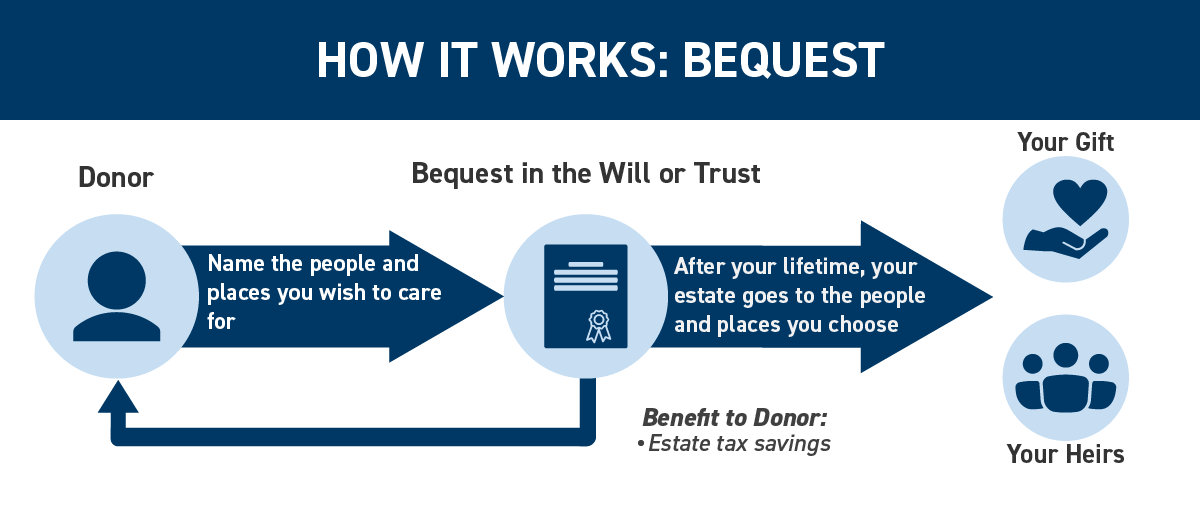

Bequest

A will represents a person’s final wishes and intentions. After providing for your loved ones, please consider one final act of generosity through a bequest in your will or living trust that provides enduring support for our vital work. For many of us, this will be the most significant gift we will make—our gift of a lifetime.

Tools to Make a Bequest

If you have not done so, you need to make a will or a living trust instrument. This is a significant and important undertaking. If you have a will or living trust, you may see your attorney to make an amendment.

Types of Bequests

- Specific Bequest: You may leave a specific asset or assets, such as real estate, securities or a specific dollar amount.

- Percentage Bequest: You may leave a specific percentage of your overall estate to Second Presbyterian Church.

- Residuary Bequest: You may gift the remaining balance of the estate after all specified distributions are made and all obligations have been satisfied.

- Contingent Bequest: A contingent bequest is one that takes effect only if the primary beneficiary or beneficiaries of the bequest are unable to accept the bequest. Usually this means that the primary beneficiary does not survive the benefactor or else disclaims the property. By naming Second Presbyterian Church as contingent beneficiary, Second Presbyterian Church would receive your generous bequest only if the purpose of the primary bequest cannot be met.

Sample Bequest Language

Bequest of a Specific Amount or Asset

A specific bequest ensures that specific property that you designate will pass to Second Presbyterian Church. You might consider the following language as an example:

Specific Amount

“I hereby give, devise and bequeath $(amount) to Second Presbyterian Church at 600 Pleasant Valley Drive, Little Rock, AR 72227 to be used for its general use and purpose.”

Specific Asset

“I hereby give, devise and bequeath (description of property) to Second Presbyterian Church at 600 Pleasant Valley Drive, Little Rock, AR 72227 to be used for its general use and purpose.”

Percentage Bequest

A bequest can be made as a percentage of the whole or of the residuary of the estate to Second Presbyterian Church, using the following language as an example:

“I hereby give, devise and bequeath to Second Presbyterian Church at 600 Pleasant Valley Drive, Little Rock, AR 72227 (all or a percentage) of the rest, residue and remainder of my estate, both real and personal, for its general use and purpose.”

Residuary of Your Estate

A residual bequest is made from the remaining portion of your estate after the will or trust has distributed each of the specific bequests and all other expenses and taxes. The following is sample language:

“I hereby give, devise and bequeath the rest, residue and remainder of my estate to Second Presbyterian Church at 600 Pleasant Valley Drive, Little Rock, AR 72227 for its general use and purpose.”

Contingent Bequest

“If (Name of beneficiary) predeceases me or disclaims any interest in (description of property), I give such property to Second Presbyterian Church at 600 Pleasant Valley Drive, Little Rock, AR 72227 for its general use and purpose.”

*It is important that you consult your attorney and/or professional advisors to consider the application of this language to your individual circumstances as part of an overall estate plan.

Video Guide

Next Steps

Contact us to talk more specifically about options and benefits.

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Securities

Gifts of appreciated stocks, bonds and mutual funds

Giving in sensible and effective ways may help minimize your tax-burden and stretch your charitable dollars.

A gift of appreciated securities provides meaningful support for Second Presbyterian Church and may offer you benefits of reduced tax liability. When you make a gift of appreciated securities, which you have held for more than 12 months, you may avoid the long-term capital gains tax and may deduct the full fair market value of the securities you give.

Gifts of appreciated securities include stocks, bonds, or mutual fund units. The following are some ways that securities held long-term (more than 12 months) can offer potential tax savings:

- Eliminating the capital gains tax on the appreciation that would have been due had you sold the securities on the open market and then donated the proceeds.

- Claiming a charitable deduction against up to 30% of your adjusted gross income. Deduction amounts exceeding this limit may be carried forward over the next four years.

To achieve these benefits, your securities must be transferred to Second Presbyterian Church, not sold, redeemed or exchanged. If they are sold from your account, the gift becomes a cash gift rather than a gift of securities, and you will personally realize any capital gains.

If you are considering a gift of securities that have decreased in value since purchase, it may be more advantageous for you to sell them and then claim the loss on your tax return, and then contribute the cash proceeds for a charitable deduction.

Next Steps

Contact us to talk more specifically about options and benefits.

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

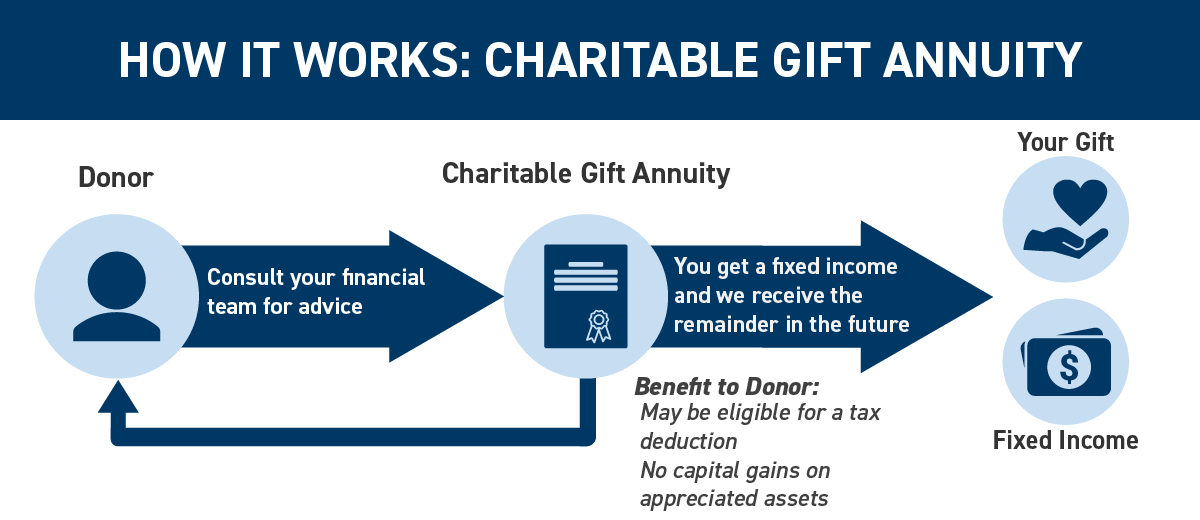

Charitable Gift Annuity

A gift that provides income

A charitable gift annuity can provide support for Second Presbyterian Church and income for you. A charitable gift annuity is established through a simple contract and an irrevocable gift of assets in exchange for a fixed amount of income to you (or whomever you designate) for life or for a set term. After the lifetime of the annuitant, the remainder is distributed to Second Presbyterian Church.

Benefits for you:

- Income: Payments are distributed for life or a fixed period to you or to whomever you designate.

- Income payment taxation: Your annuity payments may be treated as part ordinary income, part capital gains income, and part tax-free for your estimated life expectancy.

- Immediate tax deduction: Your initial gift may be eligible for a tax deduction the year the annuity is established and any unused deductions may be used over the next four years as long as you itemize and maximize your available deductions each year.

- Capital gains: You may avoid some capital gains tax when using appreciated securities.

- Your generous gift: After the lifetime(s) of annuitant(s), the remaining value is distributed as your generous gift.

How much income can I expect?

How would a charitable gift annuity work for you? The Texas Presbyterian Foundation, one of our partner providers, has a gift calculator to help you assess the potential benefits. The calculator does not require any personal information and provides your exact potential income and tax benefits.

Next Steps

Contact us to talk more specifically about options and benefits.

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Retirement Assets

Protecting the Value You Pass On:

A gift of retirement assets may be worth significantly more if you donate it to Second Presbyterian Church, Little Rock than if you pass it to your heirs. Consider leaving your loved ones less heavily taxed assets and donating your retirement assets to our church, providing meaningful support for our ministries.

When passed to your heirs, qualified retirement assets are subject to federal and, if applicable, state income taxes. An additional tax is levied for taxable estates. By choosing to leave this gift to Second Presbyterian Church, Little Rock the full un-taxed value goes toward our ministries.

The Many Benefits

- A Tax-Efficient Planned Gift: Qualified retirement accounts are subject to income tax when received by your heirs, so they may owe income taxes on the balance of the retirement account. For estates subject to estate tax, federal estate tax can erode the value even further. As a non-profit organization, Second Presbyterian Church Little Rock does not pay any federal income or estate tax on the distribution. The full value is converted into our work.

- Higher value assets to heirs: Pass along to your heirs a wide range of other assets that are not subject to income tax.

- Simple set-up: a simple form is all you need. While no attorney needs to be involved, it is practical to touch base with your professional advisors for their counsel.

- During your lifetime, you continue to use and receive distributions from your retirement accounts.

- Flexibility: If your circumstances change, you may easily change the beneficiary designations at any time.

Steps to gift an IRA, 401k, 403b:

- Consult with your professional advisers to make sure this gift fits your charitable and estate plan.

- Request and complete a beneficiary designation form from your retirement account administrator. When listing Second Presbyterian Church, Little Rock as beneficiary of an retirement account, please use the following address to ensure your request is honored: 600 Pleasant Valley Drive, Little Rock, AR 72227.

- Your generous gift will be come directly to Second Presbyterian Church outside of your estate.

Video Guide to Giving Retirement Assets

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Give & Get Income

Charitable Gift Annuity

A gift that provides income

A charitable gift annuity can provide support for Second Presbyterian Church and income for you. A charitable gift annuity is established through a simple contract and an irrevocable gift of assets in exchange for a fixed amount of income to you (or whomever you designate) for life or for a set term. After the lifetime of the annuitant, the remainder is distributed to Second Presbyterian Church.

Benefits for you:

- Income: Payments are distributed for life or a fixed period to you or to whomever you designate.

- Income payment taxation: Your annuity payments may be treated as part ordinary income, part capital gains income, and part tax-free for your estimated life expectancy.

- Immediate tax deduction: Your initial gift may be eligible for a tax deduction the year the annuity is established and any unused deductions may be used over the next four years as long as you itemize and maximize your available deductions each year.

- Capital gains: You may avoid some capital gains tax when using appreciated securities.

- Your generous gift: After the lifetime(s) of annuitant(s), the remaining value is distributed as your generous gift.

How much income can I expect?

How would a charitable gift annuity work for you? The Texas Presbyterian Foundation, one of our partner providers, has a gift calculator to help you assess the potential benefits. The calculator does not require any personal information and provides your exact potential income and tax benefits.

Next Steps

Contact us to talk more specifically about options and benefits.

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

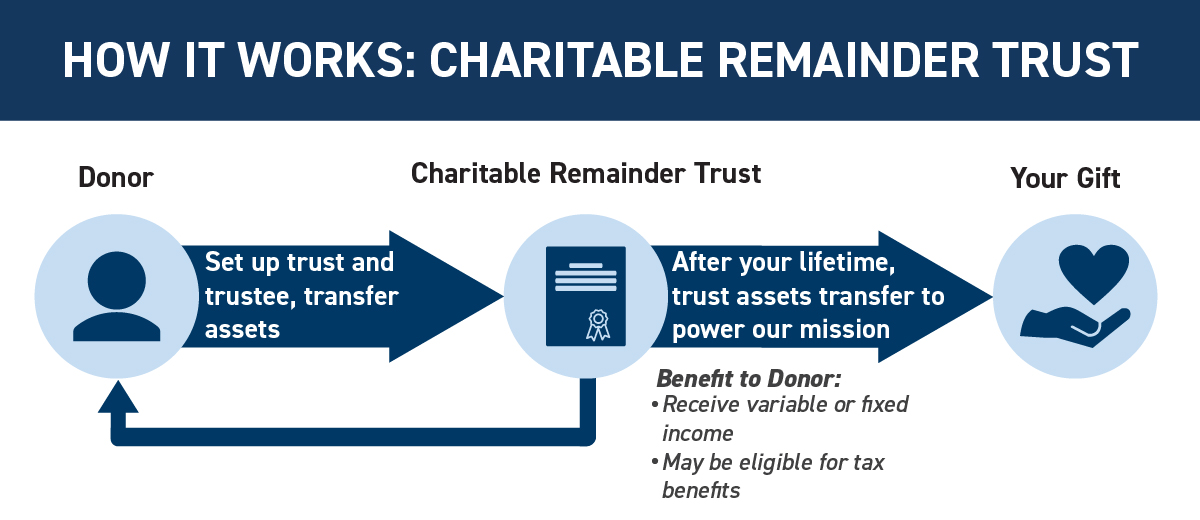

Charitable Remainder Trust

A gift that can provide income and more

A charitable remainder trust begins with an irrevocable gift of assets into a charitable trust that provides you a fixed or variable income for life or for a set term. At the trust’s termination, the trust assets become a generous gift to Second Presbyterian Church.

Types of Charitable Remainder Trusts:

- Unitrust: The unitrust’s income varies on an annual basis. At the establishment of the trust, a reasonable and permissible income percentage rates is determined. Annually, the trust assets are valued, and the established rate is applied to the annual value in order to determine your income. As the trust assets increase or decrease, your income increases or decreases as well. It may be possible to make additional contributions to the trust.

- Annuity Trust: The income is predictable and fixed. When you establish the trust, you set a reasonable and permissible fixed annual income based on a percentage of at least 5% of the initial market value of the trust’s assets. Even as the value of the trust fluctuates, your income remains the same – except in the very unlikely and uncommon event that the trust assets are exhausted. Additional contributions to the trust are not permitted.

Benefits for you

- Income: Payments are distributed for life or a fixed period to you or to whomever you designate.

- Tax deductions: You may be eligible for a tax deduction the year the trust is established.

- Capital gains: You may avoid up front capital gains tax.

- Estate tax: Trust assets are not a part of your estate.

Video Guide

Next Steps

Contact us to talk more specifically about options and benefits.

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Give Now

Cash

A simple, effective way to maximize your deductions

A gift of outright cash provides the largest immediate deduction from your taxable income. It also provides an immediate benefit to Second Presbyterian Church, allowing us to put your gift to work right away. You can give any amount, although it is important to know that the IRS allows you to claim up to 60% of your adjusted gross income (AGI) in charitable gifts of cash. You may carry the unused portion of any deduction forward for any of the next four years if you choose.

Benefits to You

- Simple and fast, minimizes gift planning

- Provides a full charitable deduction

- Maximizes your deduction

Next Steps

Contact us to talk more specifically about options and benefits.

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Securities

Gifts of appreciated stocks, bonds and mutual funds

Giving in sensible and effective ways may help minimize your tax-burden and stretch your charitable dollars.

A gift of appreciated securities provides meaningful support for Second Presbyterian Church and may offer you benefits of reduced tax liability. When you make a gift of appreciated securities, which you have held for more than 12 months, you may avoid the long-term capital gains tax and may deduct the full fair market value of the securities you give.

Gifts of appreciated securities include stocks, bonds, or mutual fund units. The following are some ways that securities held long-term (more than 12 months) can offer potential tax savings:

- Eliminating the capital gains tax on the appreciation that would have been due had you sold the securities on the open market and then donated the proceeds.

- Claiming a charitable deduction against up to 30% of your adjusted gross income. Deduction amounts exceeding this limit may be carried forward over the next four years.

To achieve these benefits, your securities must be transferred to Second Presbyterian Church, not sold, redeemed or exchanged. If they are sold from your account, the gift becomes a cash gift rather than a gift of securities, and you will personally realize any capital gains.

If you are considering a gift of securities that have decreased in value since purchase, it may be more advantageous for you to sell them and then claim the loss on your tax return, and then contribute the cash proceeds for a charitable deduction.

Next Steps

Contact us to talk more specifically about options and benefits.

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

IRA Qualified Charitable Distribution

A giving opportunity for those over 70 1/2:

Federal legislation allows you to make Qualified Charitable Distributions (QCD) from your IRA directly to a qualified 501(c)3 charity, such as Second Presbyterian Church. This Qualified Charitable Distribution (QCD) is not recognized as taxable income, but may qualify as part or all of your annual Required Minimum Distribution (RMD).

Basics of the IRA Qualified Charitable Distribution:

- Donors must be age 70 1/2 or older at the time of transfer.

- Gifts up to $100,000 per individual taxpayer are eligible per tax year.

- Distributions must be made (1) directly from the trustee (2) directly to the qualified charity.

- The gift must be complete by December 31 of the calendar year in which the Qualified Charitable Distribution is being made.

Benefits

- The Qualified Charitable Distribution (QCD) qualifies toward the owner’s Required Minimum Distribution (RMD).

- The Qualified Charitable Distribution (QCD) is not included in the owner’s Adjusted Gross Income, so no taxes are owed on this gift.

Additional Information

- Is there a charitable tax deduction? There is not. The Qualified Charitable Distribution (QCD) allows the IRA owner to avoid paying income taxes that were deferred when the funds were initially deposited into the IRA. Normally, withdrawals from IRA’s are subject to income tax. However, Qualified Charitable Distributions (QCD’s) from IRA accounts are not considered taxable income to the donor; therefore, these gifts do not qualify as tax deductions.

- Gifts can NOT be made from 401(k) or 403(b) or other employer-sponsored retirement accounts. However, it may be possible to complete a tax-free transfer from these employer-sponsored retirement accounts into an IRA from which a charitable distribution may be made.

- Qualified Charitable Distributions (QCD) can NOT be used to establish Charitable Remainder Trusts, Charitable Gift Annuities or Donor Advised Funds.

Video Guide to IRA Qualified Charitable Distributions

Next Steps

Contact us to talk more specifically about options and benefits.

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Give Later

Bequest

A will represents a person’s final wishes and intentions. After providing for your loved ones, please consider one final act of generosity through a bequest in your will or living trust that provides enduring support for our vital work. For many of us, this will be the most significant gift we will make—our gift of a lifetime.

Tools to Make a Bequest

If you have not done so, you need to make a will or a living trust instrument. This is a significant and important undertaking. If you have a will or living trust, you may see your attorney to make an amendment.

Types of Bequests

- Specific Bequest: You may leave a specific asset or assets, such as real estate, securities or a specific dollar amount.

- Percentage Bequest: You may leave a specific percentage of your overall estate to Second Presbyterian Church.

- Residuary Bequest: You may gift the remaining balance of the estate after all specified distributions are made and all obligations have been satisfied.

- Contingent Bequest: A contingent bequest is one that takes effect only if the primary beneficiary or beneficiaries of the bequest are unable to accept the bequest. Usually this means that the primary beneficiary does not survive the benefactor or else disclaims the property. By naming Second Presbyterian Church as contingent beneficiary, Second Presbyterian Church would receive your generous bequest only if the purpose of the primary bequest cannot be met.

Sample Bequest Language

Bequest of a Specific Amount or Asset

A specific bequest ensures that specific property that you designate will pass to Second Presbyterian Church. You might consider the following language as an example:

Specific Amount

“I hereby give, devise and bequeath $(amount) to Second Presbyterian Church at 600 Pleasant Valley Drive, Little Rock, AR 72227 to be used for its general use and purpose.”

Specific Asset

“I hereby give, devise and bequeath (description of property) to Second Presbyterian Church at 600 Pleasant Valley Drive, Little Rock, AR 72227 to be used for its general use and purpose.”

Percentage Bequest

A bequest can be made as a percentage of the whole or of the residuary of the estate to Second Presbyterian Church, using the following language as an example:

“I hereby give, devise and bequeath to Second Presbyterian Church at 600 Pleasant Valley Drive, Little Rock, AR 72227 (all or a percentage) of the rest, residue and remainder of my estate, both real and personal, for its general use and purpose.”

Residuary of Your Estate

A residual bequest is made from the remaining portion of your estate after the will or trust has distributed each of the specific bequests and all other expenses and taxes. The following is sample language:

“I hereby give, devise and bequeath the rest, residue and remainder of my estate to Second Presbyterian Church at 600 Pleasant Valley Drive, Little Rock, AR 72227 for its general use and purpose.”

Contingent Bequest

“If (Name of beneficiary) predeceases me or disclaims any interest in (description of property), I give such property to Second Presbyterian Church at 600 Pleasant Valley Drive, Little Rock, AR 72227 for its general use and purpose.”

*It is important that you consult your attorney and/or professional advisors to consider the application of this language to your individual circumstances as part of an overall estate plan.

Video Guide

Next Steps

Contact us to talk more specifically about options and benefits.

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Retirement Assets

Protecting the Value You Pass On:

A gift of retirement assets may be worth significantly more if you donate it to Second Presbyterian Church, Little Rock than if you pass it to your heirs. Consider leaving your loved ones less heavily taxed assets and donating your retirement assets to our church, providing meaningful support for our ministries.

When passed to your heirs, qualified retirement assets are subject to federal and, if applicable, state income taxes. An additional tax is levied for taxable estates. By choosing to leave this gift to Second Presbyterian Church, Little Rock the full un-taxed value goes toward our ministries.

The Many Benefits

- A Tax-Efficient Planned Gift: Qualified retirement accounts are subject to income tax when received by your heirs, so they may owe income taxes on the balance of the retirement account. For estates subject to estate tax, federal estate tax can erode the value even further. As a non-profit organization, Second Presbyterian Church Little Rock does not pay any federal income or estate tax on the distribution. The full value is converted into our work.

- Higher value assets to heirs: Pass along to your heirs a wide range of other assets that are not subject to income tax.

- Simple set-up: a simple form is all you need. While no attorney needs to be involved, it is practical to touch base with your professional advisors for their counsel.

- During your lifetime, you continue to use and receive distributions from your retirement accounts.

- Flexibility: If your circumstances change, you may easily change the beneficiary designations at any time.

Steps to gift an IRA, 401k, 403b:

- Consult with your professional advisers to make sure this gift fits your charitable and estate plan.

- Request and complete a beneficiary designation form from your retirement account administrator. When listing Second Presbyterian Church, Little Rock as beneficiary of an retirement account, please use the following address to ensure your request is honored: 600 Pleasant Valley Drive, Little Rock, AR 72227.

- Your generous gift will be come directly to Second Presbyterian Church outside of your estate.

Video Guide to Giving Retirement Assets

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Endowed Gifts

Ensuring Second Presbyterian Church’s mission now, tomorrow and forever.

Each of us wants to know the people and places we love will thrive even after our lifetimes. Fortunately, today you can plan your resources to know this will happen—even after you are gone.

Through your endowed gift you can be confident that your work will continue here at Second Presbyterian Church forever. An endowment is a fund which is invested in perpetuity and distributes an annual income which will prove to be vital to Second Presbyterian Church Little Rock’s mission.

You have worked hard to earn and save throughout your lifetime. You can be assured that your gift will be used well and be honored for all future generations here at Second Presbyterian Church Little Rock.

Endow your Annual Gift

Your annual gift is an important part of how we fund our mission. Would you like to consider making your annual gift in perpetuity? Establishing an endowment is a sensible way to ensure this happens. Most endowments generate 5% to distribute annually, so as a general rule of thumb an endowment may be 20 times your annual gift. For many this sum may not be immediately available and so might choose to set up their own endowment through their will or trust. Here are sample amounts for an endowment based on gift size:

| FOR THIS SIZE ANNUAL GIFT | YOU MIGHT ESTABLISH THIS SIZE ENDOWMENT |

|---|---|

| $1,000 | $20,000 |

| $2,000 | $40,000 |

| $2,500 | $50,000 |

| $5,000 | $100,000 |

| $10,000 | $200,000 |

| $20,000 | $400,000 |

| $50,000 | $1,000,000 |

Benefits

- You will be able to share your faith and extend your financial support for future generations beyond your lifetime.

- You can name your endowment fund.

- Endowment funds are tax deductible, depending on the asset given and method chosen to give.

Next Steps

Please contact us to design a gift that is unique for your passion and wishes.

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Account Beneficiary Designation

Perhaps the simplest and easiest planned gift:

Giving a financial account after your lifetime is as simple as completing a beneficiary form. Since the beneficiary form dictates the beneficiary, the asset is not controlled by your will. So there is no expensive set-up or visit to your attorney.

There are several types of financial accounts that are passed according to your beneficiary designations – instead of through your will.

- Bank accounts: To gift a checking or savings account, a “POD” or Payable on Death designation transfers the bank account to the “POD” beneficiary. You may wish to consider designating Second Presbyterian Church as a POD beneficiary of a bank account not needed by heirs to help continue our important work.

- Investment or brokerage accounts: A “TOD” or “Transfer on Death” designation directs your broker to move your designated investment securities to a new owner, Second Presbyterian Church if you wish.

- Qualified retirement plans: like IRA, 401(k) and 403(b) accounts may be worth significantly more if you donate them than if you passed them to a beneficiary (other than a spouse). And it can have a real impact on our mission. Roth IRA’s may also be designated but do not have as dramatic tax savings.

- Life insurance policies: If your existing insurance policy is no longer needed, you might simply change your primary beneficiary of the existing policy to be Second Presbyterian Church. If your loved ones still need the security of the policy, consider listing Second Presbyterian Church as a contingent beneficiary.

Steps to Gift An IRA, 401k, 403b:

- Consult with your professional advisers to make sure this gift fits your charitable and estate plan.

- Request and complete a beneficiary designation form. When listing Second Presbyterian Church as beneficiary of an retirement account, please contact us to ensure your request is honored.

- Your generous gift will come directly to Second Presbyterian Church outside of your estate.

Account Beneficiary Video Guide

Next Steps

Contact us to talk more specifically about options and benefits.

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

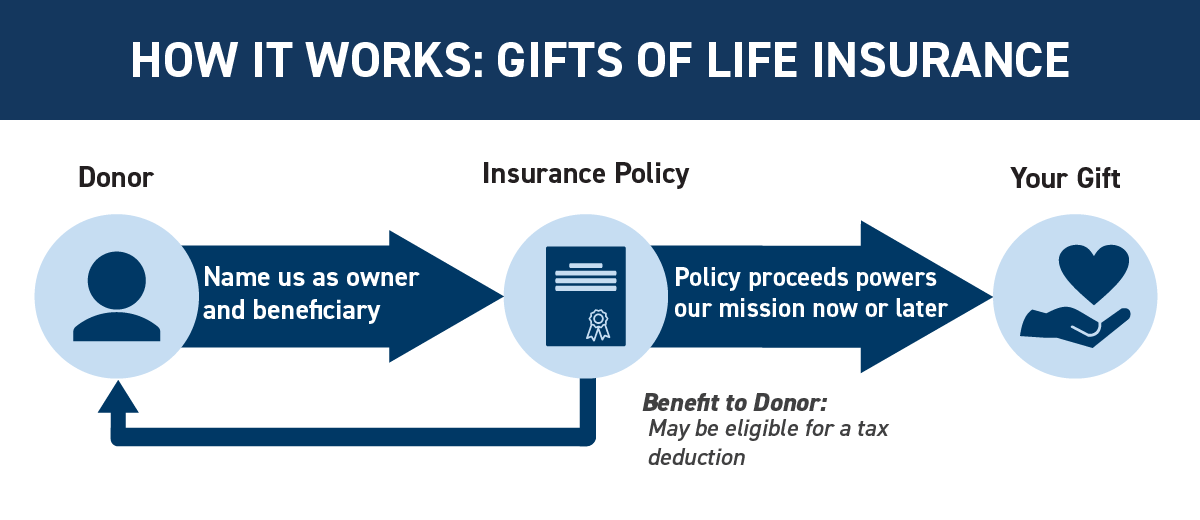

Life Insurance

A most generous gift:

Life insurance’s primary goal is to protect our loved ones. In situations where life insurance has served its original purpose, it can be a wonderful and significant gift to Second Presbyterian Church.

Steps to Gift Insurance

- Request a designation form from your insurer.

- Name Second Presbyterian Church as owner and beneficiary of your paid-up life insurance policy (see table below for other strategies). When making Second Presbyterian Church owner and/or beneficiary of an insurance policy, please contact us to ensure your request is honored.

- You are eligible for a tax deduction for the cash value of the policy.

- Your generous gift of an existing insurance policy may be kept for future benefit or cashed in by Second Presbyterian Church.

Here are some other ways to make a gift of life insurance.

| GIFT OPTION | TAX BENEFITS |

|---|---|

| Donate a paid-up policy | Deduct the approximate cash-surrender value |

| Purchase a new life insurance policy | Deduct the premiums if Second Presbyterian Church is named the owner |

| Donate a policy where you continue to pay premiums | Deduct the approximate cash value and future premiums |

| Name Second Presbyterian Church as the beneficiary (primary, secondary or contingent) | No immediate tax benefits available, but the asset is not included in your taxable estate |

Next Steps

Contact us to talk more specifically about options and benefits.

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.